franklin county ohio sales tax rate 2019

A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax. Michael stinziano 2019 property tax rates for 2020 franklin county auditor expressed in dollars and cents on each one thousand dollars of assessed valuation libr local city voc non business credit owner occupancy non business owner occupancy credit dst spec cnty twp school vill school total class 1 class 2 no.

Washington Property Tax Calculator Smartasset

Other cities in the Franklin county include Dublin Grove City Reynoldsburg and Hilliard.

. 6 rows The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales. This is the total of state and county sales tax rates. The Ohio state sales tax.

Fredericksburg OH Sales Tax Rate. Has impacted many state nexus laws and sales tax collection requirements. There were no sales and use tax county rate changes effective.

Franklin County Ohio Sales Tax Rate 2019. If this rate has been updated locally please contact us and we will update the sales tax rate for Franklin County Ohio. Food Assistance Job Family Services.

Fremont OH Sales Tax Rate. Freeport OH Sales Tax Rate. Catfish Restaurants In Grove Ok.

Sales Tax Table For Franklin County Ohio. The County assumes no responsibility for errors. - Map of current sales tax rates.

The Franklin County Sales Tax is 125. Some cities and local governments in Franklin County collect additional local. The sales and use tax rate for Lucas County 48 will increase from 725 to 775 effective April 1 2022.

Italian Restaurants Milwaukee Area. 2019 - March 31 2019. To learn more about real estate taxes click here.

The 2018 united states supreme court decision in south. Did South Dakota v. Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 75 in Franklin County Ohio. Fredericktown OH Sales Tax Rate. The effective tax rate was 18 percent in 2020 about the same in 2019 and 22 percent in 2015.

The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance for which you may be entitled. - The Finder This online tool can help determine the sales tax rate in effect for any address in Ohio. Franklin county ohio sales tax rate 2019.

3 rows Franklin County OH Sales Tax Rate. The minimum combined 2022 sales tax rate for Franklin County Ohio is. Ohio Works First Applicant Job Search Job Family Services.

Child Support Child Support Enforcement. Franklin County sales tax. Wayfair Inc affect Ohio.

123 Main Parcel ID Ex. The Franklin sales tax rate is 0. Frazeysburg OH Sales Tax Rate.

Some cities and local governments in franklin county collect additional local sales taxes which can be as high as 06. The minimum combined 2022 sales tax rate for Franklin Ohio is 7. Fresno OH Sales Tax Rate.

The Ohio sales tax rate is currently 575. The current total local sales tax rate in Franklin. The 75 sales tax rate in columbus consists of 575 ohio state sales tax 125 franklin county sales.

Franklin 125 050 750 Putnam 125 700 Fulton 150 725 Richland 125 700 Gallia 150 725 Ross 150 725. Auto Title Clerk of Courts. All numbers are rounded in the normal fashion.

Franklin County has the city of Columbus as its county seat and with a population of 13 million it is the most populous county in Ohio. The median property tax also known as real estate tax in Franklin County is 73300 per year based on a median home value of 15610000 and a median effective property tax rate of 047 of property value. If you need access to a database of all Ohio local sales tax.

The current total local sales tax rate in Franklin OH is. 21200 VIRGIL H GOODE HIGHWAY LLC. Franklin Furnace OH Sales Tax Rate.

HIGH ST 17TH FLOOR COLUMBUS OH 43215-6306. This is the total of state county and city sales tax rates. Franklin County OH Sales Tax Rate.

Search for a Property Search by. John Smith Street Address Ex. The sales tax rate for Franklin County was updated for the 2020 tax year this is the current sales tax rate we are using in the Franklin County Ohio Sales Tax Comparison Calculator for 202223.

Voter Registration Search Board of Elections. Sales Tax Reno Nv 2021. OH Sales Tax Rate.

4 rows Ohio state sales tax. Building Permits Economic Development Planning. ZIP County Rate ZIP County Rate ZIP County Rate ZIP County Rate County Rate Table by ZIP Code May 2022 43001 Licking 725 43002 Franklin 750 43003 Delaware 700 43003 Morrow 725 43004 Franklin 750 43004 Licking 725 43005 Knox 725 43006 Coshocton 775 43006 Holmes 700 43006 Knox 725 43007 Union 700 43008.

To calculate the sales tax amount for all other values use our sales tax calculator above. How to Compare Sales Tax in. Franklin OH Sales Tax Rate.

Name Change Probate Court. The divisions duties include the collection of delinquent taxes and working with property owners account holders tax lien purchasers and other interested parties with tax related issues. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

The County sales tax rate is 125.

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Sales Taxes In The United States Wikiwand

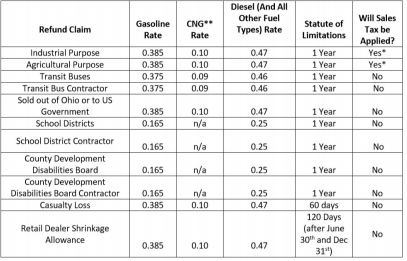

Ohio Raises Motor Fuel Taxes But Not On Everybody Lexology

Sales Taxes In The United States Wikiwand

Income Tax City Of Gahanna Ohio

Greater Dayton Communities Tax Comparison Information

Sales Taxes In The United States Wikiwand

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Ohio Sales Tax Guide And Calculator 2022 Taxjar

How To Reduce Virginia Income Tax

Florida Sales Tax Rates By City County 2022

Ohio Sales Tax Rates By City County 2022

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions